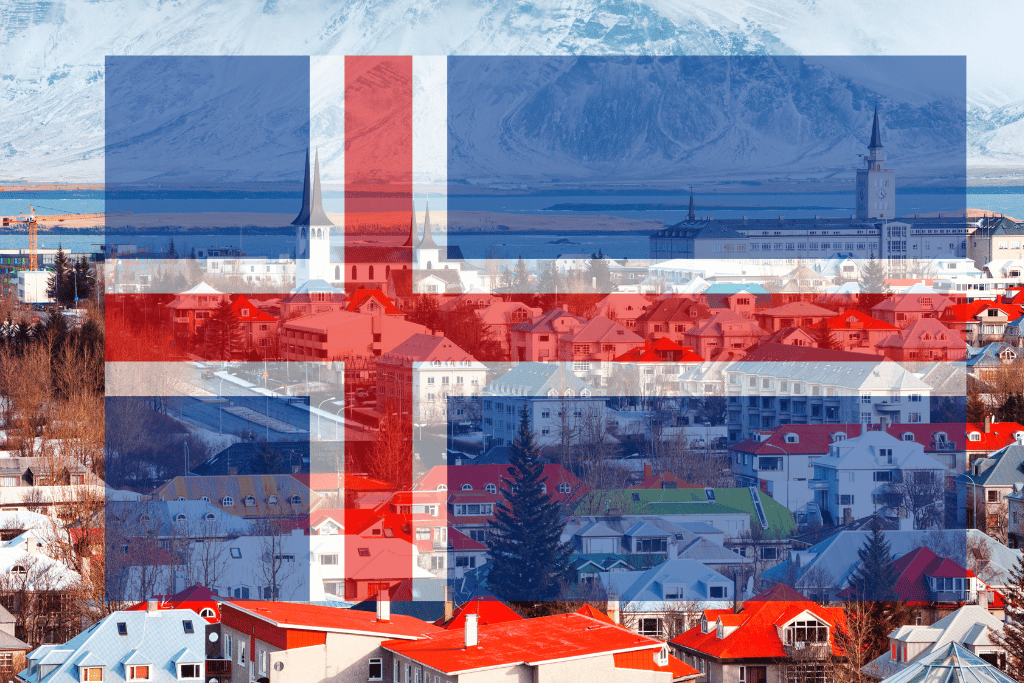

Iceland has become a popular tourist destination in recent years, with its stunning scenery, unique culture, and abundance of outdoor activities. However, the country has also been struggling to manage the impact of tourism on its environment and infrastructure.

In an effort to address these concerns, Iceland’s Prime Minister, Katrín Jakobsdóttir, has announced plans to implement a new tourism tax. The tax is expected to be implemented in 2024 and will be charged to all visitors to Iceland, regardless of their nationality.

The tourism tax will be collected by the Icelandic Tourist Board and will be used to fund a variety of initiatives, including:

- Protecting and managing Iceland’s natural resources

- Developing and maintaining sustainable tourism infrastructure

- Promoting responsible tourism practices

The Prime Minister has stressed that the tourism tax will be “modest” and will not have a significant impact on the cost of visiting Iceland. She has also said that the tax is necessary to ensure that Iceland can continue to be a sustainable and enjoyable destination for visitors.

The announcement of the tourism tax has been met with mixed reactions from the tourism industry. Some operators have expressed concern that the tax will deter visitors, while others have said that they support the tax as a way to protect Iceland’s environment and culture.

It is still too early to say what impact the tourism tax will have on Iceland’s tourism industry. However, it is clear that the government is committed to managing the impact of tourism in a sustainable way.

Benefits of the tourism tax

The tourism tax has a number of potential benefits, including:

- Protecting Iceland’s environment: The tax can be used to fund initiatives such as restoring damaged ecosystems, protecting wildlife, and developing sustainable tourism infrastructure.

- Promoting responsible tourism: The tax can be used to educate visitors about responsible tourism practices and to encourage them to minimize their impact on the environment.

- Supporting local communities: The tax can be used to support local businesses and communities that are impacted by tourism.

Potential concerns

Some people have expressed concerns about the tourism tax, including:

- Impact on visitors: The tax could deter some visitors from traveling to Iceland, especially those on a budget.

- Impact on the tourism industry: The tax could hurt the tourism industry, which is a major source of revenue for Iceland.

- Fairness: The tax is charged to all visitors, regardless of their nationality or length of stay. This could be seen as unfair, as some visitors may have a greater impact on the environment and infrastructure than others.

Conclusion

The tourism tax is a controversial topic, but it is clear that Iceland is committed to managing the impact of tourism in a sustainable way. The tax has the potential to benefit both the environment and the local community, but it is important to ensure that it is implemented in a fair and transparent manner.

Additional thoughts

In addition to the benefits and concerns mentioned above, it is also worth noting that the tourism tax could also be used to fund research into the impact of tourism on Iceland. This research could help the government to develop more effective policies for managing tourism in the future.

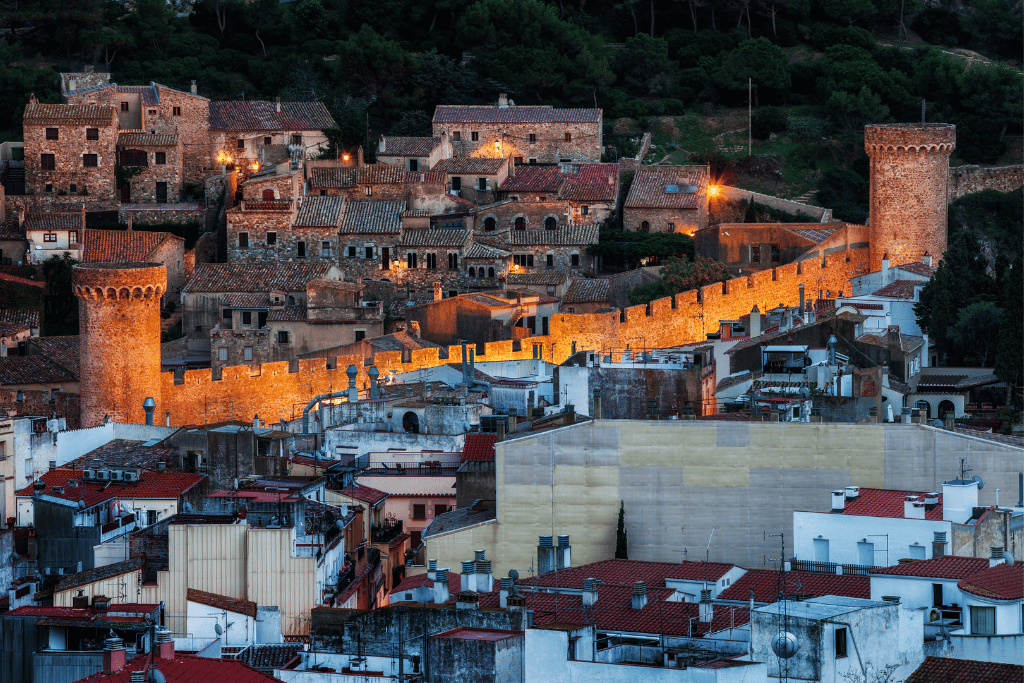

It is also important to note that the tourism tax is not a new idea. Many other countries around the world already charge a tourism tax, including Norway, Sweden, and Denmark. The taxes in these countries are typically modest and have not had a negative impact on tourism.

Overall, the tourism tax is a positive step forward for Iceland. It is a way to ensure that the country can continue to be a sustainable and enjoyable destination for visitors.